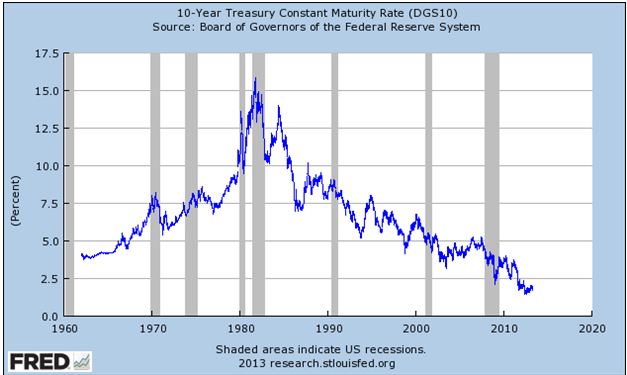

It’s not new news that interest rates are at historic lows. As I write this post the 10-year Treasury rates are 1.7%. That means the government is paying bondholders $17 per year for each $1,000 it borrows. At the end of 10 years, the government will return the face value of $1,000 to the bond holder. The graph below tracks the 10-year Treasury bond yield as it moved upward from about 4% in the early 1960s to over 15% in the ’80s and then a persistent downward trend to 1.7% today.

It’s not new news that interest rates are at historic lows. As I write this post the 10-year Treasury rates are 1.7%. That means the government is paying bondholders $17 per year for each $1,000 it borrows. At the end of 10 years, the government will return the face value of $1,000 to the bond holder. The graph below tracks the 10-year Treasury bond yield as it moved upward from about 4% in the early 1960s to over 15% in the ’80s and then a persistent downward trend to 1.7% today.

So what do rising interest rates mean to a bond investor? After all, getting paid a higher interest rate is a good thing. Right?

True, but here’s the wrinkle for those who own bonds. Interest rates and bond prices move in opposite directions. As interest rates rise — bond prices fall. Investors can lose money. Here’s an example that may clarify why this occurs. An investor, let’s call him Low Rate Ralph, buys a new 10-year government bond for $1,000 at the current 1.7% interest rate (yield). He will receive $17 per year in coupon payments for 10 years. At maturity, Ralph will get his initial $1,000 back.

The day after his purchase, 10-year interest rates rise to 2.0%. Ralph decides to sell his bond and buy a new bond that will pay him 2 percent.

Along comes High Rate Helen looking to buy a 10-year Treasury. She can buy Ralph’s bond paying $17 a year, or she can buy a new 10-year Treasury for $1,000 and receive $20. Helen won’t buy Ralph’s bond for $1,000 and get $17 when she can buy a new bond for $1,000 and get $20 a year. She’s not dumb. She talks to her investment advisor and agrees to pay Ralph $973 for his bond. This price gives Helen the same 2% yield she would get if she bought a new bond and held it to maturity. Helen will receive $17 a year in interest payments and $1,000 in 10 years when the bond matures. To calculate a bond’s price you can go here.

What about Ralph!? He paid $1,000 for a bond then sold it one day later for $973. That’s a loss of 2.7 percent.

How do you avoid losing money on bonds when interest rates rise?

Stay clear of longer maturity bonds and bond funds. Focus on short- to intermediate-term bonds. If you invest in a bond fund check the fact sheet for the fund’s ‘duration’. It measures the price movement one could expect for each percentage point move in interest rates. Let’s say your bond fund has a 5 year duration. For each 1% rise in interest rates your fund’s price would be expected to drop by -5.0%. If your fund’s duration was 15 years, you would anticipate a -15% price decline.

Bonds play an important role in a portfolio. How you structure the bond allocation in your portfolio is very important in this low-interest rate environment. To read my earlier post relating to bonds, go to “Three Reasons to Include Bonds in your Retirement Portfolio”.

I do enjoy comments, so please reply to this post below.

All website and blog information is provided solely for convenience purposes only and readers should consult with their investment advisor and/or tax professional prior on any investment decisions.